Nonprofits are typically composed of hardworking professionals who wear many hats. While each staff member may have a specific title like “fundraising director” or “project manager,” they often take on a wider range of responsibilities. This could mean handling tasks from donor communications to procurement to event planning to accomplish everything that needs to be done to further the organization’s mission.

However, some areas of nonprofit work require more specialization. In particular, effective financial management relies on having experts on your team with specific skills and knowledge in that area.

That’s right, experts, plural. In this guide, we’ll cover the four financial roles your nonprofit needs to fill in order to properly manage its resources, which are:

- Nonprofit Accountant

- Nonprofit Bookkeeper

- Nonprofit Chief Financial Officer (CFO)

- Nonprofit Treasurer

Employing multiple people to handle your nonprofit’s finances helps ensure that one person isn’t overwhelmed with this major task. Plus, they can check each other’s work to reduce errors and prevent financial risks at your organization. Let’s get started!

1. Nonprofit Accountant

According to Jitasa, a nonprofit accountant is a professional who helps your organization “ensure financial health and stability, analyze financial data, and make decisions based on the nonprofit’s unique financial position.” Their duties include analytical tasks like reconciling bank statements and balancing transactions in your accounting software, and reporting responsibilities like filing your nonprofit’s annual tax return and preparing W-2s for each of your employees.

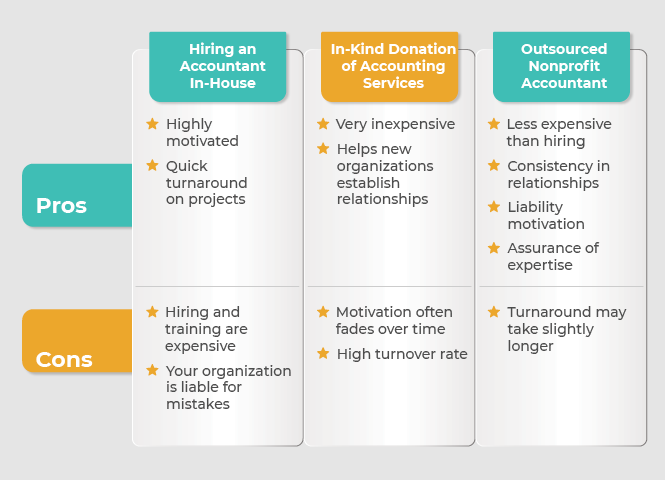

There are three ways for your nonprofit to access accounting services, each of which comes with its own pros and cons:

- Hiring an accountant in-house. Large nonprofits often bring on a full-time staff member to handle their many accounting responsibilities. In-house accountants provide the quickest turnaround on projects and tend to be highly motivated. However, this isn’t the best option for small to mid-sized organizations since hiring and training a new staff member is expensive, plus your nonprofit would also be liable for any mistakes they make.

- Receiving an in-kind donation of accounting services. If your nonprofit is just starting out, having a local accountant donate their time and expertise allows you to set up your accounting system at no cost while developing one of your first community relationships. The drawback here is that free accounting services aren’t sustainable. When an accountant doesn’t get paid, their motivation may fade over time, and they’ll focus on projects for other organizations who pay them.

- Outsourcing to an accounting firm. This option is less expensive than hiring but still allows your nonprofit to develop a consistent relationship with expert professionals. The firm will be liable for any mistakes they make rather than your organization, which can motivate them to produce high-quality work. Because these firms have many clients, turnaround time may be slightly longer, so you’ll need to plan ahead and communicate effectively with them to complete projects.

No matter which option you choose, make sure your accountant specializes in nonprofit work. Nonprofit accounting is very different from for-profit accounting, so your accountant should be familiar with the unique goals and complexities of your organization’s situation.

2. Nonprofit Bookkeeper

While accountants focus on long-term data analysis and reporting, bookkeepers take care of your nonprofit’s day-to-day financial needs. According to NXUnite, the main duties of a nonprofit bookkeeper include:

- Financial data collection and record-keeping

- Check writing and bank deposits

- Payroll processing

- Expense allocation for programs and fundraising campaigns

Although bookkeeping requires some basic training, your bookkeeper doesn’t need a specialized education or certification (unlike your accountant, who must have at least a bachelor’s degree in accounting or a related field and a CPA certification). So, your nonprofit can assign bookkeeping duties to any staff member with financial knowledge or even a trusted volunteer.

3. Nonprofit Chief Financial Officer (CFO)

Large nonprofits typically have a CFO on their organizational leadership team who works closely with other leaders like the executive director and development director. For small to mid-sized organizations who may not have the resources or need to hire another executive, fractional nonprofit CFO services provide access to all of the expertise of a full-time CFO on a part-time basis.

Whether your organization goes the full-time or fractional route, your CFO will take the lead on:

- Creating your nonprofit’s annual operating budget.

- Forecasting and evaluating cash flows in and out of your organization.

- Establishing financial policies and internal controls that govern how your employees handle resources.

- Developing a grant management system to help secure critical funding.

If accountants are in charge of financial analysis, and bookkeepers are responsible for financial record-keeping, the key word to associate with your nonprofit CFO is strategy. As the financial expert on the leadership team, they ensure that your organization’s resource use is strategically aligned with its overarching goals.

4. Nonprofit Treasurer

When it comes to your organization’s treasurer, the key word to associate with their responsibilities is oversight. This is because the treasurer is the financial expert on your nonprofit’s board of directors.

Your treasurer’s responsibilities will include:

- Approving the operating budget and financial policies that the CFO has developed.

- Directing your nonprofit’s risk management efforts.

- Preparing for financial audits and making plans to implement your auditor’s recommendations.

- Creating monthly or annual treasurer reports to inform the rest of the board and other key stakeholders about your organization’s financial status.

Your treasurer is the financial liaison between your nonprofit’s staff and board. They review the financial plans and reports your staff complete, then report back to the board so they can sign off on these documents before they’re implemented.

Although each nonprofit financial role has a different area of expertise, they work together on many essential processes. Take budgeting, for example, where your CFO will take the lead on the creation of your organization’s operating budget. However, their financial plan is based on data recorded by your bookkeeper and analyzed by your accountant, and your treasurer has to review and approve the budget to make it official.

When you have these four experts working together on your nonprofit’s finances, you’ll be better equipped to generate revenue for your mission, spend your funding wisely, and invest in your organization’s future growth.