Finding new ways to grow your donor relationships, and your revenue, starts with having the right data. One of the most valuable but underutilized data points in any nonprofit’s donor database is employer information. Knowing where your donors work can unlock a range of fundraising opportunities, especially when it comes to corporate gift matching and workplace giving campaigns. That’s where employer appends come in.

These tools help you enrich your records by automatically identifying and adding employment data to your donor profiles. But with so many options out there, how do you know which provider is right for your organization?

In this post, we’ll break down what makes a great employer append, review the top providers available to nonprofits, and offer tips for getting the most out of your investment.

- What is an employer append?

- What to look for in an employer append provider

- Top employer appends for nonprofits (rated)

- Making the most of your employer append for workplace giving

If you’re new to data enrichment or looking to upgrade your current approach, this guide will give you the clarity and confidence to choose the right partner. Let’s dive into the essentials of employer appending so you can start turning employment data into real workplace giving results.

What is an employer append?

An employer append is a specific type of data enhancement tool that helps nonprofits fill in missing employment information for their donors. By cross-referencing your existing donor records with external data sources—like public databases, social profiles, and proprietary datasets—these services can identify where your donors work and return details such as employer name, job title, and workplace giving eligibility.

The goal? To give you a fuller picture of your supporters and open the door to new workplace fundraising opportunities. For example, once you know a donor’s employer, you can check whether that company offers a matching gift program or is a good candidate for sponsorship or partnership outreach.

Typically, employer append services work like this:

- You upload a list of donor records (usually including name, email, address, and/or phone number).

- The provider uses algorithms and data matching techniques to find employment details.

- You receive a report or updated file with enriched donor data, ready to import into your CRM or workplace giving platform.

Regardless of whether you’re building a more targeted outreach strategy or simply looking to unlock hidden revenue through corporate giving, an employer append service is a powerful (and often overlooked) resource for smarter corporate fundraising.

What to look for in an employer append provider

Not all employer appends are created equal. To get the best results, and the most significant return on your investment, it’s important to choose a provider that meets your nonprofit’s specific needs.

Here are some key factors to consider when evaluating employer append options:

1. Data Accuracy and Match Rates

The effectiveness of an append starts with how accurately it can match your donor records to the right employer. Look for providers that use high-quality data sources and offer transparent match rate expectations. Bonus points if they provide confidence scores or accuracy percentages for each record.

2. Depth of Workplace Giving Data

Some offerings only return basic employer names, while others include workplace giving opportunities and beyond. The more workplace giving information you have, the better you can segment and personalize your corporate giving outreach and the more you can maximize your revenue potential from these programs, so consider how much detail you actually need for your strategy.

3. Turnaround Time

How quickly will the provider return your enriched data? Processing speed can vary widely between services. If you’re working on a time-sensitive campaign or appeal, it’s important to choose a provider that can deliver results promptly and reliably.

4. Pricing and Transparency

When it comes to data appends, pricing models can vary significantly. Some providers charge per record appended, while others offer flat-rate packages or subscription-based access. Make sure you understand the total cost upfront and compare it to your potential return. This is especially true if you’re planning to use the data for workplace giving-related outreach!

5. Workplace Fundraising Platform Integrations

If the append results can be used directly with your existing fundraising workplace giving automation tool like Double the Donation, it can save you serious time and manual effort. For the best results, look for tools that streamline your workflow.

6. Customer Support and Onboarding

A provider that offers hands-on support, clear documentation, or onboarding assistance can make a big difference, especially if you’re new to data appending. Don’t underestimate the value of good, responsive customer service!

7. Reputation and Nonprofit Experience

Finally, you’ll want to choose an offering that understands the unique needs of the nonprofit sector. Look for testimonials, case studies, or references from other organizations like yours to ensure the provider in question has a solid track record.

All in all, selecting the right employer append partner isn’t just about ticking boxes. It’s about finding a solution that empowers your team to work smarter and raise more for your cause. Take the time to evaluate your options carefully, and you’ll be set up for long-term success.

Top employer append services for nonprofits (rated)

When it comes to enriching your donor data with employment information, choosing the right tool for your employer append can make a major difference in both accuracy and measurable outcomes. Below, we’ve reviewed and rated two leading offerings that provide employer data enrichment for nonprofits.

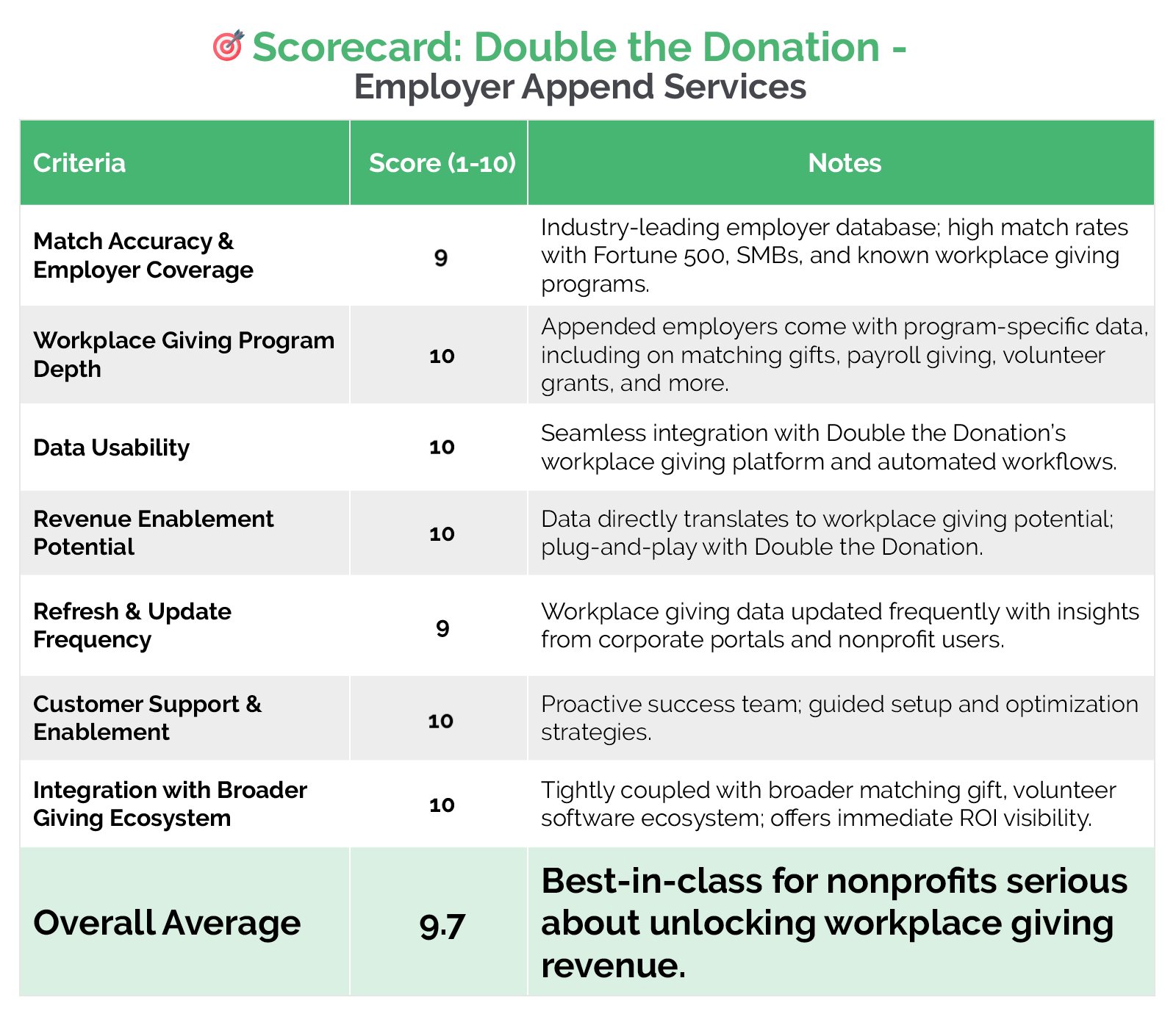

Double the Donation

Overall rating: 9.7/10

Overview:

Double the Donation is widely recognized as the leader in workplace giving solutions, and they can help you append employment information to your donation records for specific workplace giving targeting. Designed specifically for nonprofits and schools, this platform not only provides reliable employer data but also connects that data directly to actionable workplace giving insights.

Key Features:

- Access to the industry-leading corporate giving database, covering thousands of matching gift, volunteer grant, and payroll giving programs, along with broader corporate giving opportunities like in-kind donations and sponsorships.

- Appended employer info comes with automated workplace giving eligibility insights.

- Built-in tools to automatically trigger follow-up emails to donors about workplace giving opportunities.

Pros:

✅ High match rates and data accuracy

✅ Direct fundraising impact through workplace giving tools

✅ Award-winning support teams

✅ Ideal for organizations focused on maximizing workplace giving revenue

Cons:

❎ Not a general-purpose data append provider (focused exclusively on connecting employer info to corporate philanthropy insights)

Best For:

Nonprofits of all shapes and sizes looking to increase workplace and corporate giving revenue and automate employer-based fundraising strategies.

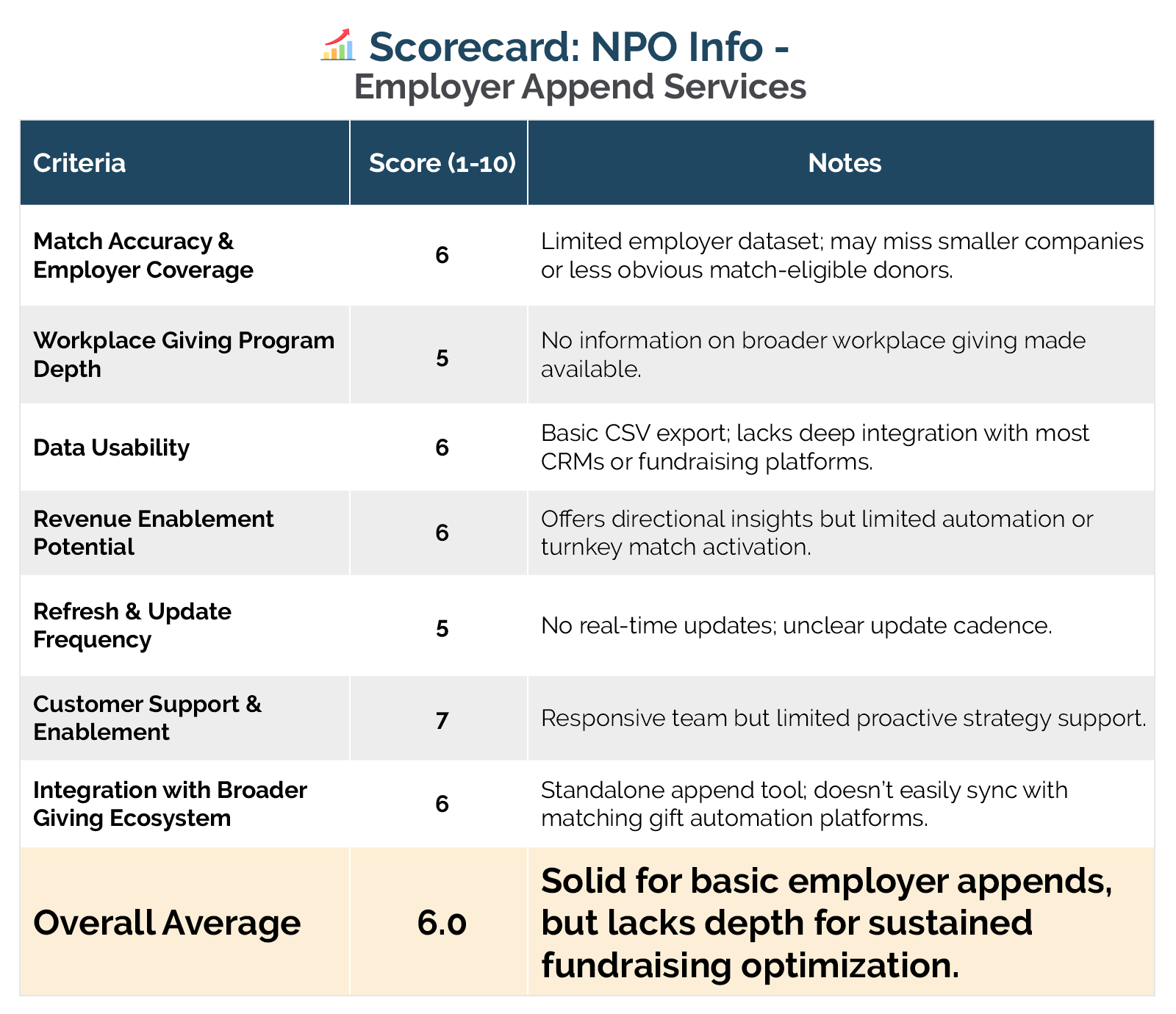

NPO Info

Overall rating: 6/10

Overview:

NPO Info is an employer append service specifically designed for nonprofits. Their employer append service is straightforward and reliable, with custom pricing and helpful support.

Key Features:

- Employer name appended based on name, email, and address matching

- Manual and automated matching processes for improved accuracy

- Customizable employer append packages based on your data needs

Pros:

✅ Nonprofit-specific focus

✅ Flexible pricing

✅ Easy-to-use reporting

Cons:

❎ Incomplete information on corporate giving programs

❎ No workplace giving automation or integration with your workplace fundraising communication platforms

Best For:

Nonprofits looking to improve general donor data hygiene and enhance donor records for manual segmentation and research.

Bottom Line:

If your goal is simply to learn where your donors work, both tools offer solid solutions. But if you’re serious about unlocking revenue from that information, especially through workplace giving programs, Double the Donation is the clear winner. With unmatched corporate giving data and built-in fundraising automation, it turns employer data into real action.

Making the most of your employer append for workplace giving

Appending employer data to your donor records is a smart move, but the real value comes from how you use that information. Simply having a list of donor employers won’t move the needle unless you apply it strategically across your fundraising efforts.

In this section, we’ll walk through practical tips to help you get the highest return on your employer append investment.

Start with clean, organized donor data.

Before you run an employer append, take time to prepare your donor file. After all, employer appends rely on matching your donor records with external databases using key identifiers. If your data is incomplete, outdated, or inconsistently formatted, the chances of a correct match drop significantly.

Here’s how to prep your data for better append results:

- Standardize formatting for names, addresses, and contact fields.

- Remove duplicate records and consolidate contact info when necessary.

- Fill in missing fields wherever possible, especially email and ZIP code.

- Double-check spelling and typos, which can lead to missed matches.

- Tag high-priority donors (like major givers or recent supporters) so you can prioritize them in the append process.

Starting with a clean list not only improves your match rate; it also reduces errors and ensures the appended data is reliable enough to act on. Think of it as setting the foundation for smarter segmentation, better targeting, and stronger donor relationships.

Choose the right appends offering for your needs.

Not every employer append offers the same value, and selecting the right one can make a big difference in the success of your efforts. Ultimately, your choice should align with your organization’s size, goals, budget, and how you plan to use the appended data.

Start by identifying what you need most from the service. Are you primarily focused on boosting matching gift revenue? Do you want in-depth employment data for major donor or corporate partnership research? For nonprofits that want to act on employer data immediately, especially for relevant workplace giving opportunities, a provider like Double the Donation is hard to beat.

Incorporate employer insights into supporter outreach.

Once you’ve appended employer information to your donor records, don’t let it sit idle; put it to work. Incorporating employer insights into your outreach strategies can significantly improve donor engagement, boost response rates, and unlock new revenue through corporate giving.

Here’s how you can make employer data part of your everyday fundraising communications:

- Mention workplace giving opportunities directly. If a donor works for a company with a known workplace giving program, include that information in your follow-up emails. Personalized reminders like “Your donation may be eligible for a match from [Company Name]” or “Your donated time can unlock volunteer grants for our organization!” can prompt immediate action.

- Create customized thank-you messages. When thanking donors, mention their company if applicable. For example: “We appreciate your support—and the impact is even greater if your gift can be matched by [Employer Name].” This adds a personal touch and reinforces the workplace giving opportunity.

- Engage corporate partners more strategically. If you notice multiple donors from the same company, it may be a signal to start a conversation with that employer about partnership, sponsorship, or broader workplace giving campaigns.

All in all, employer data isn’t just a static field in your CRM. It’s a dynamic tool for relationship-building. When used thoughtfully, it allows you to speak more directly to your supporters’ identities, values, and opportunities to give more effectively.

Refresh your donor information regularly.

Employer data is valuable—but only if it stays accurate. People change jobs, get promoted, switch industries, or retire. That’s why refreshing your donor information on a regular basis is essential to keeping your outreach relevant and effective.

A one-time employer append is a great start, but ongoing data maintenance ensures you’re not relying on outdated information.

Here’s how to keep your employment data fresh and actionable:

- Schedule regular re-appends. Plan to re-run employer appends at least once a year. This helps you capture job changes and maintain a current view of your supporters.

- Capture updates directly from donors. Add a field for employer name on your donation forms, volunteer registrations, and email follow-ups. Even a simple “Where do you work?” question can provide long-term value.

- Audit your data periodically. Use your CRM tools to run reports on blank or outdated employer fields, then prioritize those records for updating.

Keeping your donor data current isn’t just a housekeeping task. It’s the key to maximizing the impact of your fundraising strategies. The more accurate your employer information, the more effectively you can identify workplace giving opportunities, personalize your outreach, and strengthen donor relationships.

Train your team to act on the data.

Having accurate employer data is only half the equation. Next, your team needs to know how to use it effectively. When staff across departments understand how to recognize, interpret, and act on employment insights, your organization can turn static data into dynamic fundraising results.

For the best results, make sure development staff know how to identify donors who work for workplace giving companies and how to initiate relevant follow-ups. You can even provide scripts, email templates, or talking points to help them make the ask confidently. Knowing a donor’s company can shape your conversations and reveal new engagement angles, too, like corporate partnerships or volunteer opportunities.

From there, as new tools or campaigns roll out, revisit how employer data supports your goals. Quick trainings or internal guides can help keep your team confident and consistent in how they apply the information.

Track results and ROI.

To truly understand the value of your employer append efforts, you need to measure the outcomes. Tracking results and return on investment (or ROI) not only shows the impact of your data enrichment, but it also helps justify future investments and identify opportunities for improvement.

Here’s how you can track the effectiveness of your employer append strategy:

- Monitor matching gift revenue growth. One of the clearest ROI indicators is an increase in matching gift dollars. Track how many gifts are matched post-append and see how much additional revenue that generates over time.

- Take a look at volunteer grants received. Many employers offer donations in exchange for volunteer hours. If your appended data reveals employer-sponsored volunteer programs, monitor whether you’re receiving more volunteer grants from identified supporters.

- Measure increases in payroll giving. Payroll giving, or automatic donations deducted from employees’ paychecks, is often facilitated through individuals’ employers. Use your appended data to encourage enrollment and track whether you see a rise in recurring gifts tied to workplace programs.

- Compare donor engagement before and after appends. Look at email open rates, click-throughs, and response rates for segments with appended employer data versus those without. Are donors with employer insights engaging more frequently or giving at higher levels?

From there, you can easily calculate cost versus return. Add up the total cost of your employer append (including staff time, if relevant) and compare it to the revenue generated through workplace giving, sponsorships, or improved engagement. Even a modest increase in donor response can justify the investment.

Wrapping up & additional employer append resources

Adding employer information to your donor database isn’t just about keeping better records. It’s about identifying new opportunities for engagement, stewardship, and revenue. The right employer append service can help you uncover hidden corporate giving potential, improve your segmentation strategies, and ultimately raise more money for your mission.

Each provider has its own strengths, so take time to evaluate which option aligns best with your nonprofit’s needs, budget, and existing tech stack. And remember: enriched data is only valuable if you act on it.

Interested in learning more about how employer append services can power your revenue-generation efforts? Check out these additional resources:

- The Ultimate Guide to Employer Appends for Fundraisers. Everything you need to know about employer appends—from what they are and how they work to the specific ways they can boost your fundraising results. This guide is perfect for beginners and pros alike.

- Is an Employer Append Right for Your Nonprofit? How to Know. Not sure if an employer append is the right move? This post walks you through key indicators, use cases, and decision-making criteria to help you determine if and when to invest.

- Avoid These 5 Employer Appending Mistakes Nonprofits Make. Make your employer append process smoother and more successful by learning what not to do. This article covers the most common employer appending pitfalls and how your organization can avoid them.