Managing your nonprofit’s finances is about more than just raising money and recording what you earn and spend. It also involves financial stewardship—the practice of saving, storing, and investing your cash reserves wisely to boost your organization’s long-term financial health.

This means it’s crucial not only to manage your organization’s reserve funds well but also to stay aware of the current financial best practices and trends in the nonprofit sector. We’ve compiled this list of up-to-date nonprofit cash management statistics and trends to help you get started. Whether you’re investing your nonprofit’s funds for the first time or looking for the right cash management strategies to keep your funds safe, these insights will help you evaluate your situation and make more thoughtful, data-driven financial decisions.

Cash Management and Nonprofit Investing Statistics

Let’s dive in by taking a look at two recent financial management statistics we’ve been keeping an eye on.

38% of nonprofits report managing investments.

In a study shared by The Nonprofit Times, 38% of nonprofits reported some kind of expenses related to managing investments, such as paying for investment advising services. This means that more than a third of nonprofits have investment accounts and actively steward their funds by investing them.

On the flip side, this also means that more than 60% of nonprofits aren’t investing. As a result, they’re hampering their potential growth and the impact they could have on their community. But this doesn’t have to be the case—it’s easier than ever to responsibly invest your nonprofit’s reserve funds and manage them effectively.

If your organization falls into that 60%, you have a great opportunity to start building an impactful investment portfolio through low-risk, highly liquid strategies like treasury bills and money market accounts. Start by discussing your needs with a nonprofit investment advisor, who will help you choose the best cash management strategies for your needs and draft a nonprofit investment policy statement (IPS) to guide your efforts.

Accepting stock donations can grow your fundraising contributions by 66%.

A Texas Tech University study compared the fundraising revenue growth of more than 200,000 nonprofits to determine whether accepting non-cash donations—particularly gifts of stock—had an impact. The results overwhelmingly showed that they do.

This study found the average increase in fundraising contributions over five years to be:

- 11% growth for nonprofits only accepting cash donations

- 50% growth for nonprofits receiving any kind of non-cash gifts

- 66% growth for nonprofits that accepted stock donations

What does this mean for your organization? Expanding your donation options to include non-cash asset gifts, especially stock donations, can greatly increase your overall fundraising capacity.

Current Financial Trends in the Nonprofit Sector

Next, let’s explore the financial trends that are redefining giving and nonprofit cash management for the better.

Keeping 6-12 months’ worth of operating costs in reserve

Because of the increase in economic uncertainty in recent years (not to mention the COVID-19 pandemic), every nonprofit now understands the importance of having funds to fall back on when they need them. This makes creating and maintaining a dedicated reserve fund, also known as a rainy day fund, essential for every organization.

In the past, some nonprofit professionals have been wary of setting aside too much funding that could be put to work for their mission right away, leading to small reserve funds that aren’t sustainable or sufficient.

Now, more and more nonprofits realize the importance of reserve funds and are sticking to the best practice of keeping at least 6-12 months’ worth of their operating costs in reserve. This way, you’ll have plenty of resources in an emergency and can rest assured that your organization is in a good financial position.

Seeking more FDIC coverage through brokerage accounts

Another challenge that’s been top of mind for a lot of nonprofits: bank failures. What happens to your reserve funds if your organization’s bank fails? How will you keep donors’ gifts safe?

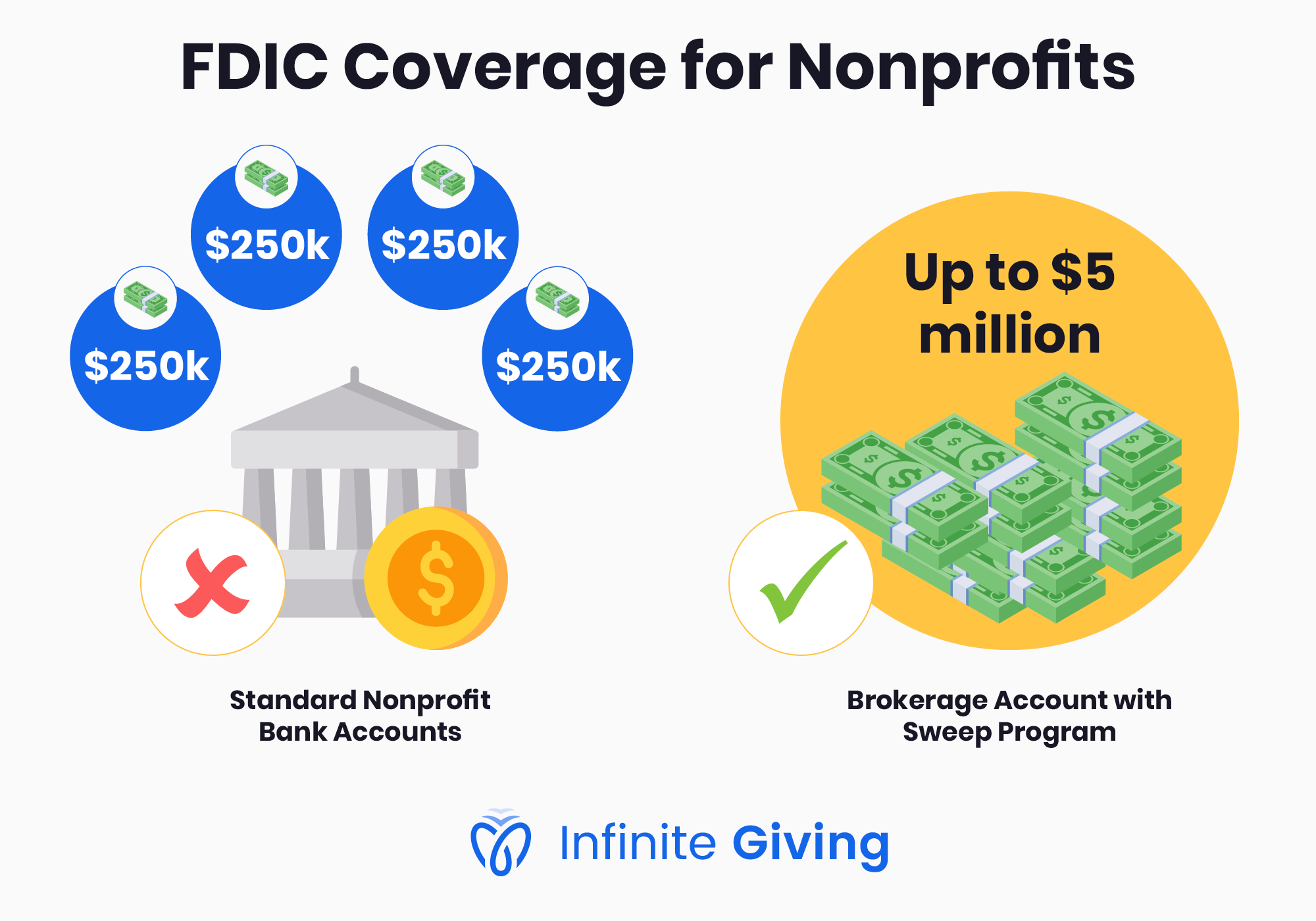

The answer lies in having enough FDIC coverage—protection and backing for your funds provided by the Federal Deposit Insurance Corporation. However, typical savings accounts have a strict limit on how much FDIC coverage you can receive. Infinite Giving’s brokerage account guide explains the key differences in coverage for different types of nonprofit accounts:

- Standard nonprofit bank accounts can only access up to $250,000 in FDIC coverage. This leads many organizations to divide their cash reserves into several different accounts, resulting in more difficult bookkeeping and restricted access to their funds.

- Brokerage accounts with sweep programs can provide up to $5 million in FDIC coverage. By using a single account with a high capacity, your organization can ensure coverage for all its reserve funds and significantly streamline your books.

Because of these differences in coverage, more nonprofits are switching to brokerage accounts that provide exponentially more FDIC coverage through sweep programs. Having a brokerage account also allows your organization to receive stock donations, which (as we’ve already discussed) can greatly increase your fundraising potential.

Making it easy to accept non-cash donations

Finally, many nonprofits realize the fundraising potential of non-cash donations like stocks and cryptocurrency and are taking steps to streamline the donation process for these gifts.

For example, stock donations have historically placed a significant burden on both donors and staff to fill out and mail hard-copy forms back and forth. As a result, they were restricted to only the largest nonprofits and most dedicated donors. Today, modern asset donation technology allows nonprofits of any size to accept stock donations through entirely online processes. This makes it easy for donors as well, encouraging them to give non-cash gifts more frequently.

In addition to stock gifts, the best tools allow nonprofits to easily accept multiple alternative forms of donations, like donor-advised fund (DAF) grants, cryptocurrency, and endowments. All of these donation types are more popular with high-capacity donors, and Double the Donation reports that nonprofits’ focus on major donors is staying strong since the most impactful donors are giving more even while total donations decrease.

Strategic cash management is critical to securing your organization’s long-term financial health and making a greater impact on your community. With a better understanding of the current state of nonprofit finance, you can make more informed decisions about how to manage your nonprofit’s funds effectively.

EXPLORE OUR NONPROFIT RESOURCES

Sign up for a webinar, tune into a podcast, take a course, or access a guide on a vast array of topics including fundraising, board governance, marketing and communications, and much more!

We are renowned for our top-nonprofit lists including the best logos, websites, and degree programs. We also have an ever-expanding blog full of valuable information to help your not-for-profit org reach its potential.