Effective financial management is essential for any organization. No matter your purpose, well-managed finances yield data-driven insights that allow those in financial positions to plan and achieve the organization’s goals.

Financial management is especially important for advocacy groups since these organizations tend to work under tight budgets and face greater challenges with maintaining public trust. To help, we’ve compiled this list of four best practices your advocacy group can implement to manage its finances more effectively.

1. Establish clear financial policies

As various team members interact with your advocacy group’s finances, they’ll need clear guidelines for handling money within your organization. Financial policies ensure consistency in your recording and reporting processes across all of your operations.

Here are a few key policies your advocacy group should establish:

- Operating reserve policy: Standardize the procedure for building your organization’s operating reserves, or its “savings account.” Your operating reserve policy should identify where the funds will come from and what they can be used for, and it should place a limit on the size of the account.

- Financial reporting policy: Create guidelines for how financial reports should be completed and submitted. Familiarize yourself with state and federal regulations when creating this policy to ensure your guidelines align with the requirements.

- Gift acceptance policy: Define which types of donations (both monetary and in-kind) are acceptable and how your organization will process them. You may also include this policy on your advocacy group’s website to clarify exactly what donations you need for page visitors who want to get involved.

Involve key stakeholders in the creation of these policies. According to Double the Donation, board members have a fiduciary responsibility to monitor your organization’s financial activity and health, meaning financial oversight is their job. Your advocacy group’s leadership can also help ensure each policy aligns with compliance standards.

2. Develop a realistic budget

Budgeting is an obvious element of your organization’s financial practices. However, to effectively manage finances for your advocacy group, you’ll need a budget that reflects your goals and funding.

For example, planning a grassroots campaign requires spending on marketing efforts, while building partnerships with other organizations may incur event-related costs. A realistic budget based on reasonable expectations will act as a guide for your organization’s spending so that you can achieve your goals.

To build a budget around your advocacy group’s resources and circumstances, you should:

- Review past spending: Understand your organization’s historical spending patterns to highlight trends that may affect your budget. For example, identify any programs that required additional funding or areas where cuts could be made.

- Estimate income: Evaluate all potential sources of income, from product fundraising revenue to in-kind donations to membership fees. Note the timing of such income to estimate your organization’s cash flow throughout the fiscal year.

- Account for fluctuations: Be prepared to revise your budget and implement a system for making adjustments as necessary. Review the budget periodically with program leaders to understand how effective your resource allocation is.

Your budget is the key to putting your strategic plan into action, so it must be tailored to advance your group’s overall goals. Ensure your budget aligns with your advocacy group’s long-term goals so that all budgetary decisions support your mission.

3. Conduct regular audits

Establishing clear policies and a realistic budget is the first step for successful financial management. However, you must maintain these practices over time to ensure your advocacy group’s finances are in order and comply with legal requirements.

Conduct regular audits to bolster your organization’s financial integrity by identifying any discrepancies, inefficiencies, or areas of noncompliance in your financial processes. There are two types of audits you can conduct:

- Internal: These audits are performed by your advocacy group’s staff or hired consultants. They involve checking for operational efficiency and compliance with internal policies.

- External: These audits are performed by independent auditing firms. They involve assessing your organization’s compliance with legal requirements and accounting standards.

Schedule both types of audits throughout the year, allowing time for sufficient preparation. Internal audits may be held quarterly, for example, while external audits could require more time to select an auditor and prepare. Also, some grantors request an audit report in their grant applications, meaning your organization must prove it’ll manage the funding well when seeking out certain types of support.

Of course, there are some steps your team can take to minimize the preparation needed before an audit. For example, Chazin & Company’s in-kind donation guide recommends recording all gifts immediately, because this “ensures your books accurately reflect your financial activity at all times.” Real-time recording makes it easier for your team to gather and review revenue data since all gifts are recorded upon receipt.

5. Consult a nonprofit accountant

While the best practices above are a great starting point, your advocacy group’s financial management will be unique to your organization’s operations and financial circumstances. To receive individualized support for your organization, consult a professional accountant with experience in nonprofit finances.

Nonprofit accounting is incredibly nuanced, requiring compliance with state and federal regulations that affect the way your organization records, budgets, and spends its resources. Even if your advocacy group isn’t a nonprofit, there are some areas of overlap in accounting for which nonprofit experience is highly useful.

Nonprofit accountants have the expertise necessary to evaluate your advocacy group’s books and help you develop effective and compliant financial strategies. Additionally, leaving accounting to a full-time professional frees your team to focus on hosting successful advocacy campaigns.

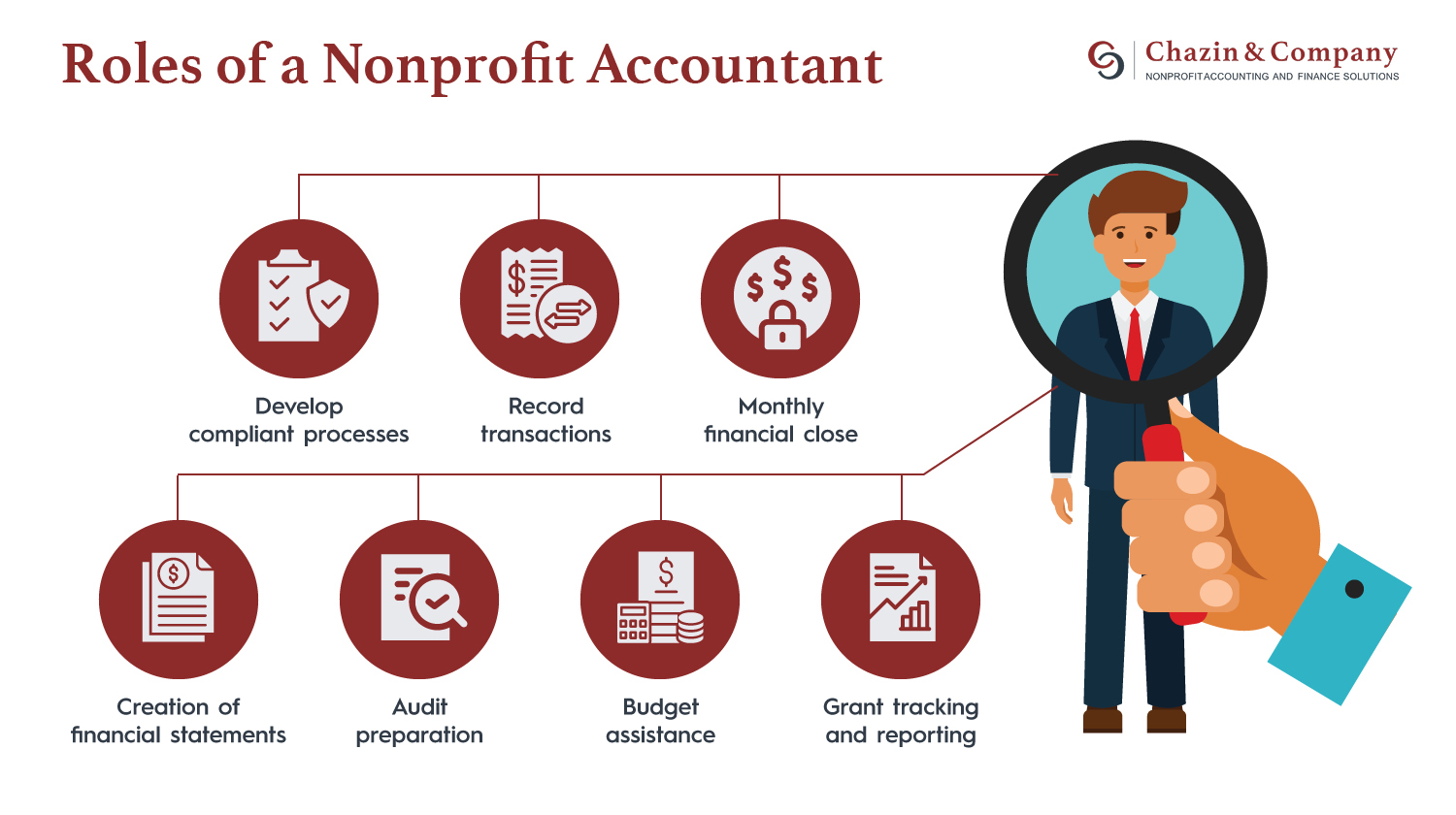

Typically, professional accountants fill the following roles:

- Develop compliant processes

- Record transactions

- Monthly financial close

- Creation of financial statements

- Audit preparation

- Budget assistance

- Grant tracking and reporting

When consulting a nonprofit accountant, ensure their communication style and approach are compatible with your team’s. Clearly define your expectations for the partnership so the accountant knows how to work smoothly with your team.

As your advocacy group refines its approach to financial management, you’ll gain a better understanding of how to effectively allocate your resources. Keep your team updated on these best practices and your organization’s financial procedures to ensure everyone is on the same page. For more support in this area of your organization’s operations, consult a nonprofit accountant.